When will mortgage rates go down?

Author:

Kevin GrahamNov 12, 2024

•12-minute read

Whether you’re in the market to buy a home or refinance your current one, interest rates are probably on your mind. They make a huge impact on affordability. It’s natural to ask yourself, “When will mortgage rates go down?” The truth of the matter is your guess is as good as anyone else’s. But there are indicators you can follow to try to get a glimpse into the future.

What are current mortgage rates?

Mortgage rates change daily and vary from lender to lender because it’s a competitive market. The best analog we have when it comes to discussing average mortgage rates is the Primary Mortgage Market Survey® from Freddie Mac.

The average is currently 6.79% for a 30-year fixed mortgage. If you want to get a 15-year term, the average reported rate was 6%.

Mortgage rate predictions

If there’s ever someone out there who can predict the future, I think what mortgage rates would be would fall somewhere very further down the list of questions. Being that no one has been able to make conclusive predictions with perfect clarity, the job of any consumer is at best to take in the information and decide what they believe.

That doesn’t stop industry participants from having opinions on where things are headed. Summarized below are the thoughts of a few major players in real estate and housing finance:

- National Association of Home Builders (NAHB): The construction trade group sees rates for 30-year fixed mortgages averaging 5.94% in 2025 and 5.69% in 2026.

- Fannie Mae: As one of the prominent backers of conventional mortgages, Fannie Mae has to keep its finger on the pulse of the housing market. The company sees rates falling to 5.7% in 2025 for a 30-year fixed.

- Freddie Mac: The other major backer of conventional loans sees rates falling slowly but steadily in the coming years, with the caveat that economic conditions could change that.

When will home loan interest rates go down?

Trying to predict timing gets into crystal ball territory and anything we told you would be a wild guess. However, the NAHB, Fannie Mae and Freddie Mac all see rates coming down in 2025.

We didn’t mention the National Association of REALTORS® because their predictions for the year ahead will be discussed at an event in mid-December. But it has mentioned that the Fed has room to cut the target for the federal funds rate 6 to 8 times. That was back in July, before the cut in September.

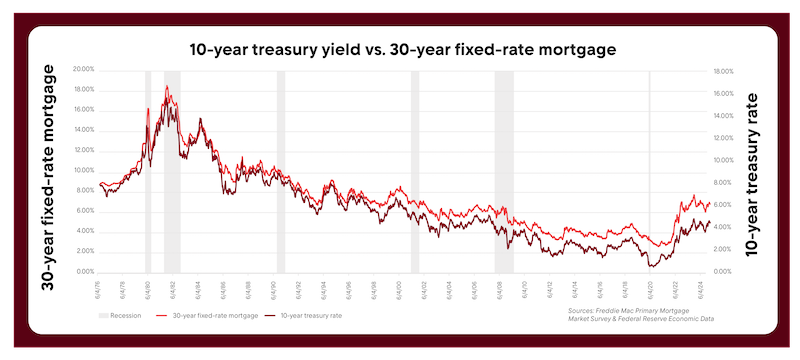

If you’re thinking about the best time to make a move when buying or refinancing a mortgage, when it comes to rates, it’s important to note that because bond traders are always trying to figure out what a fair yield will be 2 months from now. That’s because mortgage rates are directly tied to the yields on mortgage-backed securities (MBS).

While mortgage rates do tend to follow the same direction as the federal funds rate, mortgages are packaged into MBS for investors in the bond market a couple of months after your loan closes. Because of this, setting mortgage rates is an exercise in projection. We’ll get into some of the factors that traders look at soon.

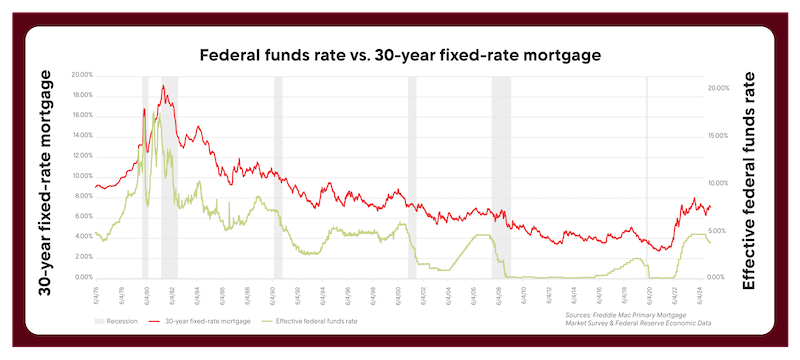

While we talk about projections, why don’t we take a minute and look at the Federal Reserve’s (Fed) own for the federal funds rate? The federal funds rate is the rate at which federally-backed banks borrow from each other overnight to fund their operations. If the borrowing costs for banks go down, rates for borrowers also come down. The reverse happens if they rise.

Each quarter, Fed officials release new projections for a variety of the key economic indicators they look at in addition to a prediction for where the federal funds rate might be headed. The current median projection among the central bank’s top minds is that the federal funds rate will average 3.4% in 2025 and 2.9% in 2026, down 1% in the next year and 1.5% in the long run.

While the Federal Open Market Committee (FOMC) did lower the target range moving forward, their projections and recent comments from officials have led traders to rethink some of their timelines regarding the pace of rate cuts.

If the market thinks rates are going to be higher than the previous projections, rates push up regardless of what the Fed does. The inverse can also happen. If the Fed pushes rates up, but the pace of hikes is slower than market participants expect, rates can fall. Either way, it doesn’t always make sense to wait for the Fed announcement.

What makes mortgage rates go down?

To know what makes mortgage rates go down, it’s important to understand the variety of factors influencing bond traders as they make the investment decisions that ultimately determine mortgage rates.

Before we go further, I want to make a quick note that the graphs below were updated as of November 1. All data points referenced in the writing are accurate as of the date of publication.

The economy

We’ll get into factors influencing your personal mortgage rate later on, because I don’t want to discount the importance of these. But when it comes to market factors, the number one influence that drives everything else is the economy. And within the economy, the two big indicators that drive the bus are inflation and the labor market.

Inflation is the rate at which prices rise. If you like low interest rates, you want inflation to be low as well. Not only does this increase your buying power, but it means officials don’t have to worry about how much money is circulating in the economy because prices are at reasonable levels.

We’ll discuss the Federal Reserve and the tools available to officials more in a minute, but the Fed would like to see inflation average 2% annually. That’s enough to keep the economy going by pushing people to buy now, while also not overly devaluing the money people already have.

In recent years, they’ve taken action to push down higher inflation levels by raising the federal funds rate. This pushes interest rates up across the economy. The idea here is that if money is more expensive to borrow, people will spend less and hold onto more of the money they have. This has the impact of taking money out of the economy, forcing sellers to moderate prices.

For this reason, there is a relationship between mortgage rates and inflation. As long as inflation remains at relatively low levels, rates can remain low. As inflation goes up, the Fed makes moves to get things under control. But inflation isn’t the only thing the Fed is charged with worrying about. Let’s talk employment.

World events

So far much of what we’ve talked about has revolved around monetary policy. Monetary policy can be quite clean in terms of the way you think about it. Lower rates mean cheaper borrowing but also the potential for higher prices. Higher rates mean more expensive funding and the potential for a drag on the economy but encourage lower prices.

But nothing in the economy operates completely outside the context of government policy. When we speak of government involvement in the economy, this is referred to as fiscal policy. In fact, through the power of the purse, governments at all levels and to varying degrees can affect the economy as much or more than the central bank.

Governments can put more money into the economy through infrastructure projects, tax cuts or even direct payments to citizens. On the other hand, if they’re more concerned about spending deficits, they may choose to greatly cut back on spending, raise taxes or both. Because this impacts the amount of money people have access to, it can also impact interest rate policy.

It’s not just the events in the U.S. that you need to be concerned with, either. As just one example, economic uncertainty around Britain’s exit from the European Union pushed mortgage rates to near historical lows at the time. If something happens elsewhere that pushes traders into or away from U.S. bond markets, that can impact mortgage rates.

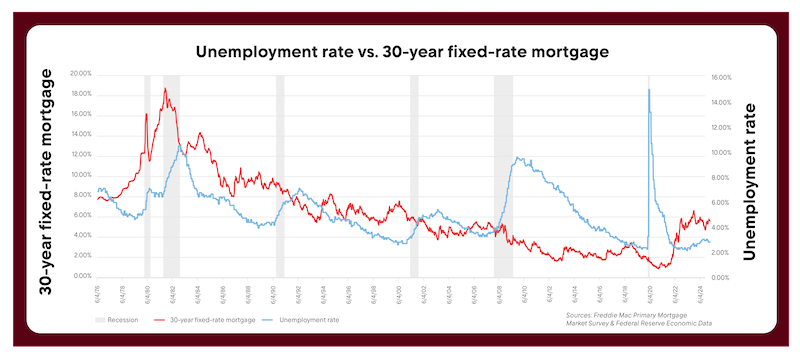

It’s important to realize that the Fed has to deal with two sides of the economy coin. If they raise interest rates, businesses end up dealing with a double whammy. Higher interest rates make business borrowing more expensive while at the same time consumers are spending less. This means layoffs, so the Fed is constantly performing a delicate high wire act.

If the Fed is too heavy-handed in dealing with the inflation problem, the unemployment rate can start to go up quite precipitously and the Fed may be left trying to lower rates. If enough people are laid off that economic growth stagnates and shrinks, that’s a recession. We last had one briefly at the beginning of the pandemic.

Along with other interest rates, you’ll typically see mortgage rates fall during a recession and in the immediate aftermath. This happens as officials try to kickstart the economy.

Beyond indicators, the sentiment of investors as they look at the economy also matters a great deal. If investors are feeling good about the economy, they tend to invest more in stocks, which are higher risk while yielding a higher return as opposed to the low-risk, lower return offered by bonds. These higher or lower yields on bonds have a direct impact on mortgage rates.

The Federal Reserve

We’ve touched a bit already on the dual mandate given to the Fed by Congress: It’s charged with maintaining stable prices and also providing for economic conditions favorable to maximum employment. To get there, the main avenue the Fed has is to put its thumb on interest rates. It does this by raising or lowering the target range for the federal funds rate.

Interest rates, including those for mortgages, go as the federal funds rate goes. Short-term lending like credit cards or auto loans are more immediately impacted than mortgage rates which are tied to MBS, but they follow the same trend line.

The other direct way that the federal funds rate can impact home loan rates is that it changes a lender’s prime rate. The prime rate is the rate that lenders are going to give their most creditworthy customers.

This varies from lender to lender, but the reason it matters for mortgages is that lenders will often use their own prime rate or a composite from several banks to serve as the index for things like adjustable-rate mortgages or home equity lines of credit. The prime rate is added to a margin to get the new rate.

The other way that the Fed influences housing specifically reflects the outsize impact of real estate on the overall economy. Gross domestic product (GDP) measures total economic growth. As a percentage of GDP, estimates for the third quarter of 2024 show that housing services and residential fixed investment make up 16.2% of total economic activity as measured by the Bureau of Economic Analysis.

Put simply, Fed officials have a vested interest in the housing market. Utilizing a playbook first run in 2008 to boost the economy, the Federal Reserve began buying copious amounts of MBS in 2020 to provide economic support during the pandemic.

With the Fed buying in large quantities, yields didn’t have to be as high and rates fell. The opposite has happened the last couple of years as they’ve sold off on a strict schedule. This also has a big impact on inflation because the lower rates are, the more people are willing to spend for housing.

The secondary market

We’ve discussed this at a high level above, but it could be helpful to understand the relationship between the mortgage rates you receive and mortgage bonds, or MBS.

It used to be that if a financial institution gave you a mortgage, they would hold onto it on their books for as long as it took you to pay off the mortgage under the terms of the loan. However, there is limited money to lend if you’re constantly waiting to recoup money you’ve lent.

While some institutions still hold loans (portfolio lending), most lenders now sell to major mortgage investors like Fannie Mae or Freddie Mac. These investors buy loans that meet their guidelines. Individual loans are then packaged into MBS, which can be purchased by individual or institutional investors.

When you close your loan with a lender, you’re participating in the primary mortgage market. When the lender then sells the loan to a mortgage investor who packages the loan with other loan with similar characteristics to be sold to other investors in an MBS, this is referred to as the secondary market.

The MBS market provides important sources of fast funding so more mortgages can be originated. However, this is where market dynamics come into play.

MBS are sold on the bond market. The upside of bonds is that they offer a guaranteed rate of return. They can, however, be susceptible to inflation risks. If the value of your bond is locked in at a rate lower than inflation, your money has lost value. There’s the potential to earn more in the stock market.

Both factors play a role in mortgage rates. In situations where people anticipate inflation will be higher, they’ll demand higher bond yields (including from MBS) to compensate. If people think the economy is doing well, they might invest in stocks for the higher return possibility. On the other hand, if people are more pessimistic, higher demand for bonds means lower yields.

The yield on mortgage-backed securities directly impacts the prime rate that mortgage lenders can charge their most qualified borrowers.

Higher yields on MBS mean higher rates, while lower yields will drop the rate.

Treasury yield curves

Treasury bonds are used to fund government operations. The investor buys a bond that funds the government. When the bond matures, they can cash in the bond for their original investment plus the interest rate determined by the yield.

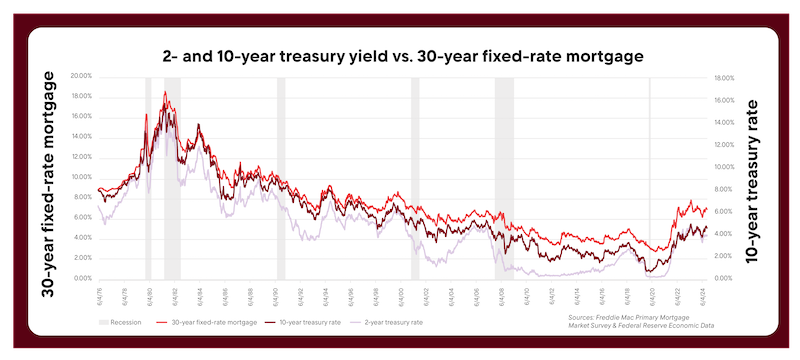

In a healthy economy, longer-term bond yields are higher than shorter-term ones because the investor should get more interest for their money being tied up longer. However, bond yields are also determined by market demand.

If people believe the economy is going to be worse in the short run, they start willingly tying their money up in longer-term bonds, which drives the yield down. If enough investors buy these bonds, the 2-year yield ends up higher than the 10-year yield. This is referred to as an inverted yield curve. The data shows that the U.S. often goes into a recession within about a year and a half.

The direction of the 10-year Treasury yield tends to correlate with the 30-year fixed mortgage rate. You’ll find they go in the same general direction despite the fact that MBS and the Treasury aren’t the same.

World events

So far much of what we’ve talked about has revolved around monetary policy. But nothing in the economy operates completely outside the context of government policy.

When we speak of government involvement in the economy, this is referred to as fiscal policy. In fact, through the power of the purse, governments at all levels and to varying degrees can affect the economy as much or more than the central bank.

Governments can put more money into the economy through infrastructure projects, tax cuts, or even direct payments to citizens. On the other hand, if they’re more concerned about spending deficits, they may choose to greatly cut back on spending, raise taxes, or both. Because this impacts the amount of money people have access to, it can also impact interest rate policy.

It’s not just the events in the U.S. that you need to be concerned with, either. As just one example, economic uncertainty around Britain’s exit from the European Union pushed mortgage rates to near historical lows at the time. If something happens elsewhere that pushes traders into or away from U.S. bond markets, that can impact mortgage rates.

How to get the lowest possible mortgage rate

Although it may impact your timing or anchor your expectations in terms of affordability, market factors are beyond your control when it comes to mortgage rates. At the same time, that’s only half the equation. Responsible lending is about making sound judgments as to your ability to pay the loan back based on measurable judgments of risk and setting rates accordingly.

There are several personal financial factors that you can control to set yourself up to get the lowest mortgage rate possible:

- Be vigilant about credit. Your credit score is one of the primary determinants of your mortgage rate, so you want it to be as high as possible. Make sure you’re regularly checking your credit report for items you don’t recognize and any other mistakes. Make on-time payments. Don’t apply for credit you don’t need and use no more than 30% of your total credit card balances.

- The higher your down payment or equity, the better. This is the other big factor when it comes to your mortgage rate. The less a lender has to give you relative to the value of the home makes you a better risk as a borrower. This leads to lower rates.

- Buy mortgage points. Mortgage points are prepaid interest credits hat lower your rate. One point equals 1% of the loan, and you can buy them in increments of 0.125%. To see if it’s worth it, divide the upfront cost by the monthly savings. If you stay longer than the break-even period, you'll save money.

The bottom line: Don’t Worry About Rates As Much As Whether You’re Ready

No one has a 100% sure method for understanding where interest rates are headed, but you can look at indicators that have their roots in the overall economy, central banks, demand for mortgage bonds, treasury yields and even events in America and around the world. At the same time, it can be better to focus on what you can control: things like credit and down payment.

We would encourage you to focus on whether you’re ready and can afford the payment rather than trying to figure out when rates are going to drop. You can always refinance down the line. If you’d like to keep an eye on mortgage rates, you can sign up for daily updates one texting “Rates” to 762538. Ready to get begin? Start an application online with Rocket Mortgage®.

Kevin Graham

Related resources

7-minute read

How are mortgage rates determined? A comprehensive look at mortgage rates

Read more

8-minute read

Mortgage interest rates forecast for 2025

Read more

11-minute read

Housing market predictions for 2025

Read more